Some of the links on this page are affiliate links. When you make a purchase through an affiliate link, I earn a commission at no cost to you. See my entire disclosure policy for all the boring details.

Whether your food budget is $100 per month or $1,000 per month, if you want to stick to the food budget you’ve decided on, you have to know how to track your grocery spending.

After all, if you have a budget, but don’t know how much you’re spending, then do you really have a budget? (Implied: no.)

I have tried tons of budgeting apps and methods for tracking grocery spending over the past 10 years, and I’ve narrowed them all down to the 4 methods that I think are the simplest & most effective.

Option #1 – Track Grocery Spending with Cash

Cash doesn’t lie.

If your weekly grocery store budget is $100, carry that around with you until it’s gone. Then, don’t spend anymore. You can take out cash weekly, bi-weekly, or monthly – whatever works.

I used a cash grocery system for a LONG time. On the way to the grocery store once a week, I’d stop at the ATM and take out $120 in cash. Then, I’d spend less than that at the store – mainly by planning ahead for meals & sticking to my shopping list! Any leftover money we ended up was bonus fun money to eat out, or buy the kids a treat during the week.

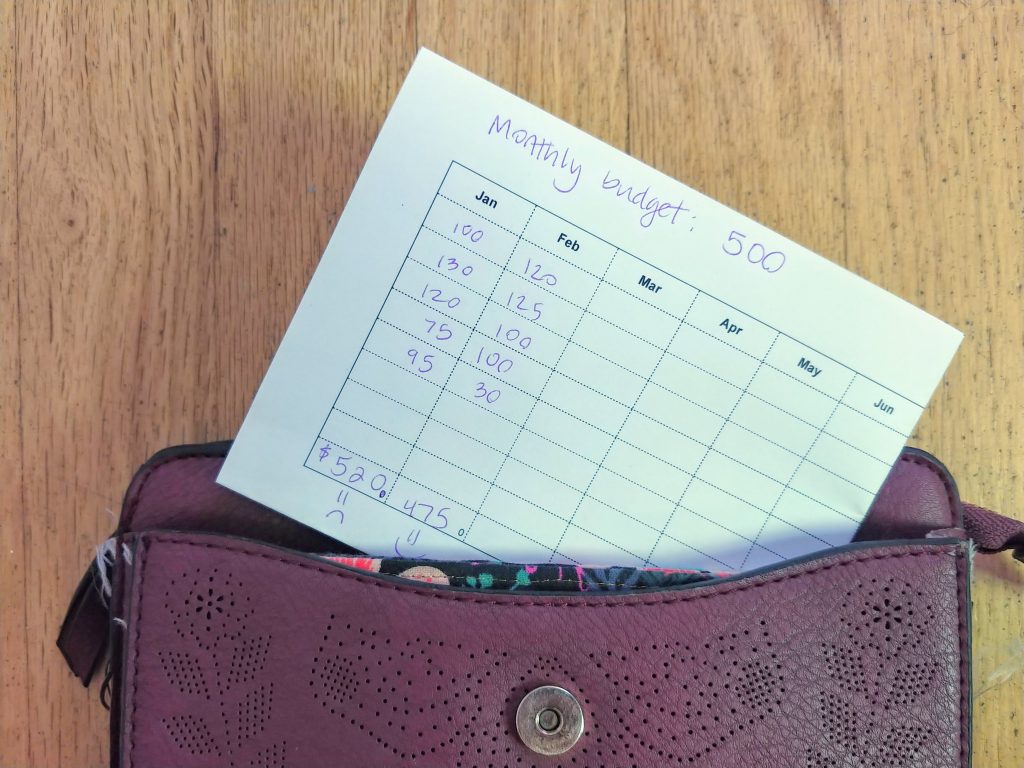

I kept my grocery cash in one of those cute fabric magnetic “envelopes” pictured above. A friend made them for me! (Here’s a tutorial, if that’s your thang.)

If I bought anything in a different budget category at the store (i.e. gardening stuff, household products, diapers, clothes, etc…), I asked the cashier to do 2 separate transactions. I paid cash for the food and used my debit card for everything else. This probably added 2 minutes to my overall time at the register. #worthit

If you want to have a bunch of different cash envelopes, here’s another tutorial on making your own sturdy cash envelopes that fit in your wallet.

I really liked using cash for groceries. I’m a spender by nature and I like how concrete cash is. When it’s gone, it’s gone. In that sense it’s easy to track.

There are a lot of cons to using cash though.

- Some people feel like it’s harder to track because they just kind of randomly spend it. My husband is in this category – he hates having cash!

- If you’re saving for something in cash, you’re piling up a lot of cash in an envelope either in your wallet, purse, or house. Your wad of dough could get lost or stolen.

- You have to hassle with going to ATMs or the bank more too.

Option #2 – Use the Cash Envelope System Without Cash

I originally saw a version of this idea from Jordan Page from Fun, Cheap or Free. She tracks most of her spending with an envelope method that’s really simple. It wouldn’t work for the way we do our other spending categories, but I think it’s great for tracking groceries!!

Here’s how I tweaked the no-cash envelope system to be for groceries only.

- Write your grocery budget on the top of the empty envelope.

- Carry it around with you.

- Put any grocery receipt in the envelope and write down how much you spent. (i.e. minus 35)

- Track your total grocery budget left on the envelope too! This way you’ll always know how much you have left.

Option #3 – Track Grocery Spending with YNAB / Grocery Budget App

YNAB is an online budgeting tool that functions like a virtual cash envelope system of sorts. YNAB stands for You Need A Budget. WE LOVE YNAB!!!! (Here’s my entire YNAB review.)

You can either:

- Connect your cards to your YNAB account

- Enter all your spending manually, one transaction at a time

- Download transactions from your bank and 1-click import them to YNAB

We use YNAB for our entire budget. It’s connected to both our credit and debit cards. We also track other personal finance things in YNAB (net worth, various savings accounts, retirement accounts, etc.).

YNAB is amazing for budgeting because it forces you to actually budget money you have instead of spending money on a card first, and hoping you can pay it off at the end of the month. And it’s very easy to use with both various expenses (like groceries) and fixed expenses (like the gas bill).

By budgeting first, then spending, you will know exactly where your money is going. I used to manually track our spending in a spreadsheet, but YNAB saves me so much time.

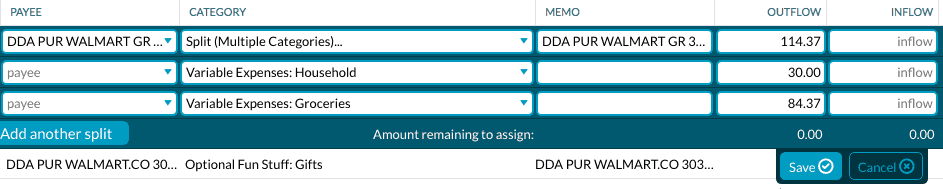

If I am at Walmart or Target and I buy clothes, diapers, household stuff, and groceries, I can easily split that spending into multiple categories.

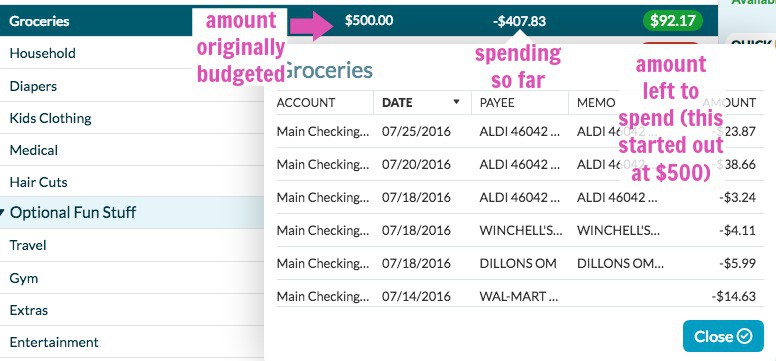

Whether you connect YNAB to your bank or import your transactions manually, you have to categorize or “approve” each transaction. As you categorize transactions in the GROCERY BUDGET category, that number goes down.

Did I mention I really really really really like YNAB? HA!

We’ve tried every budgeting tool out there, and this one is worth it’s weight in gold. It’s $6.99/ month which you will more than make up for once you start using it to track your spending. Plus you can do a free 34 day trial without even entering a credit card.

They have an app too! So you can do your grocery budget on the go within the app.

Seriously, try it. It’s awesome.

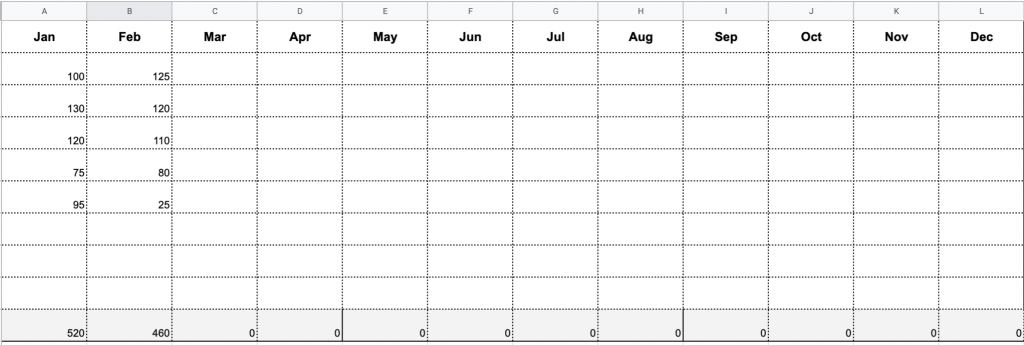

Option #4: Simple Grocery Tracking Spreadsheet

I created this simple spreadsheet for anyone who is just die-hard for spreadsheets and wants a spreadsheet to track your expenses.

You can either print it or use it on your computer.

If you print it out, it’s small enough to fit in your wallet. Just manually enter the amount you spent every time you grocery shop. Write your monthly budget goal somewhere on the top of the page!

The button below will open my spreadsheet in a Google Sheets tab. Click file –> make a copy. Then you’ll have your own editable copy of this simple spreadsheet.

Or, you can keep it on your computer, and the budget template spreadsheet will add the total monthly grocery spending for you as you enter each receipt’s amount.

If you have Google Drive (Google Sheets) on your phone, you can “star” it in Google Sheets and put a Google Sheets shortcut on your phone’s home screen. That way, this grocery tracking spreadsheet will appear at the top of Google Sheets any time you open the app.

Simple Isn’t Always Easy

Whether you use one of these options for tracking your grocery spending or come up with a totally different method, successful budgeting always comes down to willpower. If you want to stick to your personal budgets, you can figure it out.

If you have a different method for how to track your grocery spending that works well for you, I’d love to hear in the comments below.

Don’t Forget to Meal Plan!

One way to be diligent in your grocery spending is to meal plan on a regular basis… It doesn’t have to be too painful. I’ve actually found monthly meal planning dinners is less time consuming than weekly!

Buy Cheap Food!

A super easy way to cut your grocery budget is to buy cheaper food. Here is my list of 46 cheapest foods to add to your grocery list when you’re trying to cut grocery spending.

RECAPPING THE WHOLE SERIES

This post is part 3 of a 3-post series to help you simplify & get control of your food budget once and for all!

Post #1: What Should Your Grocery Bill Be? | Figure it Out with This Formula!

Post #2: How to Cut Your Grocery Bill

Post #3: How to Track Your Grocery Spending | 2 Simple Methods That Work Every Time

To recap the whole series, here’s the entire grocery bill overhaul process. Start to finish.

- Determine a realistic grocery budget based on your income, needs, and season of life.

- Figure out what you’ve been spending.

- Decide how you’re going to stick to your budget and track your spending.

- Adjust as needed.

Good luck & happy budgeting.

ah yes! mental math rounding up to nearest dollar, or keeping phone calculator open worked for me! Or, if you remember the ballpark price while you’re making your grocery list, you can actually jot down the $ next to the item on your list. Then add it all up before you go to the store and make sure you’re under budget! 🙂

Biggest problem for me is how do you track while you are in the grocery store, before checkout, how much you are purchasing so you don’t go over?

Hi Anupa! Thanks for your comment and questions. To answer your first question, it doesn’t really matter where you draw the line, as long as it’s consistent… So, for simplicity sake, most things that I place on my Walmart Grocery pickup order are grocery items 🙂 I used to separate out household/ toiletree items and groceries, and now I just lump it all together. It’s totally a personal preference! The same is kind of true with tax. Our state doesn’t tax grocery food either. When I purchase, for example, some kids clothing items & groceries at Costco, I split my receipt between “kids clothing” and “groceries.” I quickly add up the total of the kid clothing items and just add all the tax to that category since most of the groceries wouldn’t have had tax. I might have happened to buy a grocery item that did get taxed, but I don’t worry about it too much!! Don’t let yourself get too bogged down in those details if it makes budgeting stressful. Just decide and go for it consistently!!

Thank you for these useful tips! I am trying to new ways to proactively manage my finances. I really like Option #2 and I might consider something like that.

But I have a couple of questions:

1. Where do you draw the line on what a grocery item is? For instance, would items such as gum, soda, or granola bars be considered grocery item?

2. How do you account for sales tax when filling out your form/spreadsheet? I live in a state where groceries are tax exempt but things like soda and candy are not. Figuring out which items were taxed is the bane of my budgeting process because the tax is applied as a whole at the end of the receipt (rather than with each item). And it is super annoying if I am purchasing items from multiple categories at a supermarket. Thank you for the idea of separate transactions, I might start doing that as well.

Any advice you can share is greatly appreciated!