Some of the links on this page are affiliate links. When you make a purchase through an affiliate link, I earn a commission at no cost to you. See my entire disclosure policy for all the boring details.

People often feel like they don’t have enough money. Often, people think the solution to their financial problems is making more money… an “income problem,” if you will.

While it’s possible that you do have an income problem, it’s also very possible that you have a spending problem or an expenses problem. So how can you tell whether you have an expenses problem, an income problem, or a spending problem!?

If you feel constantly stressed about money, like your budget is just too tight, this post should help!

Today, we’ll figure out how much you should be spending in each category, and identify whether your situation is an income problem, spending problem, or expenses problem.

How Much Should I Spend on _______?

First of all, there is no “correct” dollar amount for each category in your budget. It’s not like $600 is the right amount to spend on groceries for a family of 4, and $800 is too much.

Each category varies greatly depending on your family’s needs, situation, and location.

It’s much more helpful to think of your spending as a percentage of your income.

Percentages Example

For example…let’s compare a $25,000 minivan with an $80,000 Lexus. Is one “better” than the other?

Say your household income is $50,000 a year. After taxes and 401k deductions, you’re likely taking home around $2,800/month.

If you own a $25,000 car, that car is worth half your annual income. And the monthly payments on it are around $450, which is 16% of your monthly paycheck. That alone would make your budget feel tight. (If that’s you, sell the car and buy a beater for cash!)

But what about the guy who owns an $80,000 Lexus and makes $500,000 a year? That car is only worth 16% of his annual income (as opposed to your 25k car being worth 50% of your annual income).

He is likely taking home around $23,000 per month, and he probably paid for his car outright.

In that scenario, your $25,000 car is way more unreasonable than his $80,000… because of the percentages.

Use Percentages When Assessing Your Spending

All that to say, thinking of your spending as a percentage of your income is much more helpful than thinking about a dollar amount you should be spending on a certain category.

Here are Dave Ramsey’s percentage guidelines for a reasonable amount of spending. If you’re a high income earner, you will probably not need to spend as much in certain categories. (His method helps a TON of people get out of debt… and it helped us! I highly recommend use these guidelines as a starting point for your own budget if things feel tight.)

| Category | Percentage of Overall Spending |

| Housing | 25-35% |

| Utilities | 5-10% |

| Transportation | 10-15% |

| Healthcare | 5-10% |

| Food | 5-15% |

| Investments/Savings | 5-10% |

| Debt Payments | 5-10% |

| Charitable Giving | 5-15% |

| Entertainment/Recreation | 5-9% |

| Misc Personal | 2-7% |

If you are spending SIGNIFICANTLY MORE than any of these guidelines, that could be the “problem category.”

It’s a SPENDING problem if…

You are spending way more than the recommended range on optional things – clothes, entertainment, recreation, personal, etc…

You also have a spending problem if you have a credit card you can’t pay off in full right now. The key to long-term financial success is learning to live on less than you make. Starting today. If you can’t pay off a credit card, then you are spending more than you make, and you will always feel stuck.

It’s an EXPENSES problem if…

You have necessary expenses (food, shelter, utilities, etc.) that far exceed the recommended ranges above. If your rent or mortgage is 50% of your monthly take home pay, you need to move or get a different job.

A couple helpful rules of thumb for the big stuff:

- The total value of vehicles that you own should be less than half your annual salary. If your household income is $50,000 the total value of all vehicles in your possession should be less than $25,000.

- Your housing payment (rent or mortgage) should be less than 35% of your monthly take home pay, ideally closer to 25% or less.

It’s an INCOME problem if…

You make less than you need to cover the bare-bones basics of everyday life.

The “rules” for thinking about the question of an income problem aren’t quite as straight forward as percentage categories. After all $35,000 goes a lot farther if you’re a recent college grad living with roommates than if you’re a single mom of 3 kiddos.

And $35,000 goes a lot farther in Nebraska than it does in New York.

Since we can’t lay down any salary numbers that constitute a definite income problem, we’ll have to use common sense to think this through.

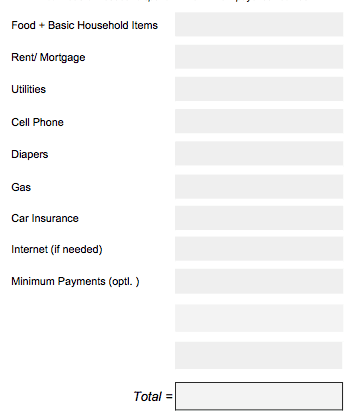

Jot down how much you need to spend per month to survive in each of the following categories:

Do you make more than that? If so, how much more? If not, how short are you?

Figuring out how much you need to survive on, then comparing that against your monthly take home pay should reveal to you whether or not you have an income problem.

If you need to spend $1,500 to survive each month and you only make $1,000, then you will always feel like you’re drowning financially.

If that is you, either your income needs to change or your necessary expenses need to change. (i.e. Sell a car, move down in house/ apartment.)

So, which is it!?

Do you have a spending problem, an expenses problem, or an income problem? Feel free to ask questions in the comments below. If you want my survival budgeting guide, click below and I’ll send it to you!

p.s. No idea how much you spend in various categories? YNAB has made budgeting SO easy for us. You can read my review about it here, or you can just go sign up for it and start budgeting immediately!