Some of the links on this page are affiliate links. When you make a purchase through an affiliate link, I earn a commission at no cost to you. See my entire disclosure policy for all the boring details.

This is the 5th post in an ongoing series called “Budgeting 101.” You can START THE ENTIRE SERIES WITH POST #1 HERE.

I wrote a post about making a budget, and I think it’s helpful if you’re new to budgeting. But especially around this time of year, I hear so many people say, “oh I’ve tried to make a budget, I just can’t stick to it.” And that used to be true for me too! In fact, 2015 was the first year we really stuck to our budget, almost all the time.

We’d made budgets before, and tried to be frugal. We stayed out of consumer debt – no credit card debt or cars that were too expensive. We talked about money frequently and tried to stick to our budget. But, often we didn’t. Until last year.

As I thought about why we were able to start sticking to a budget, I’ve decided that making the budget isn’t really the hardest part. In fact, it’s not that hard at all. You just write down some categories and a number for how much you want to spend.

I think the hardest part about a budget is sticking to it.

Can I get an ‘amen?’

As I thought more about why we were able to stick to a budget for the first year ever, I realized there were a few big shifts in thinking and habit for us to really stick to our budget.

1. We stopped thinking of the budget as a suggestion

Like I said, we’ve always tried to budget. But, if we went over budget in a category, we treated it as “oh well.” Sure, we tried not to go over budget. But if something came up that we wanted enough or thought we needed, we just said, eh we have the money, and went over budget.

At the end of the day, our budget was more of a suggestion than a contract.

Then, in December of 2014, we sat down with a huge financial goal – to pay off a massive amount of student loans in 3 years, a seemingly impossible time frame based on our income and expenses at that time. So, we relooked at our budget. But this time, our mentality had shifted. We were going to stick to it.

It sounds so simple, but at the end of December 2014, we stopped thinking about our budget as suggestion, and started thinking about it like a contract. In fact, I specifically remember that halfway through January of 2015, I wanted to order something on Amazon. As I went to find it and put it in my cart, a little voice in the back of my head said, “that’s not in your budget.”

So I didn’t order it. That was the first time that my budget had truly dictated my spending.

I took $100 to the grocery store, and if the total went over $100, I put stuff back. (Turns out we can eat on less than $100/ week.)

I went to lunch with a friend and used up my month’s spending money. So, when I wanted to start a sewing project, I realized my budget said I had to wait until the next month when I had more spending money again.

It’s not that we never went over budget again. But, almost overnight, our whole mindset about budgeting changed from seeing the budget as a suggestion to seeing it as a contract. If something comes up and it’s not in the budget, we don’t buy it. We wait, we discuss it, and we put it in the budget for another time.

2. We agreed on our “why” & talked about it often

Have you heard we’re paying off student loan debt? I only mention in like every other blog post…

But, it’s at the very forefront of our minds. This is our “why” for budgeting right now. Getting out of debt. (We have some whys for getting out of debt too… good ‘whys’ are very motivating for everything really.)

Do you have a reason why you’re budgeting? An arbitrary, abstract idea like, “I really wish I could be better at budgeting,” is not really helpful for actually sticking to your budget.

Instead, think of your budget as the BIGGEST financial tool for getting to your next financial goal. Your next financial goal is your ‘why’ of budgeting.

Answer the question: why do I want to stick to my budget? Then write it down. Think about it and talk about it often. Tell people you know. We are losing friends because we keep talking about getting out of debt. (If we have any friends when we’re done, I’m sure they’ll be glad so they don’t have to hear about it anymore…)

Get a good “why,” and think about it a lot!

3. We looked at spending together every day (at first)

Please don’t read this one and run away quickly. Hear me out. I’m reading this book about habit which I’d highly recommend. In it, the author explains through tons of research, case studies, examples, etc… that habits are a cycle of cues, routines, and rewards.

In order to start new habits, you have to figure out what the old routine is and replace it with a new one… until it becomes the new habit for that very same cue. The old habit never really goes away, you just replace it with a new one.

We’d tried every form of budgeting under the sun. We were in the habit of kinda sorta looking over our month’s spending, seeing where we went over budget and saying, “let’s try to do better next time.”

Ben and I needed a new budgeting habit. And we weren’t sure what it should be. So we got a little extreme.

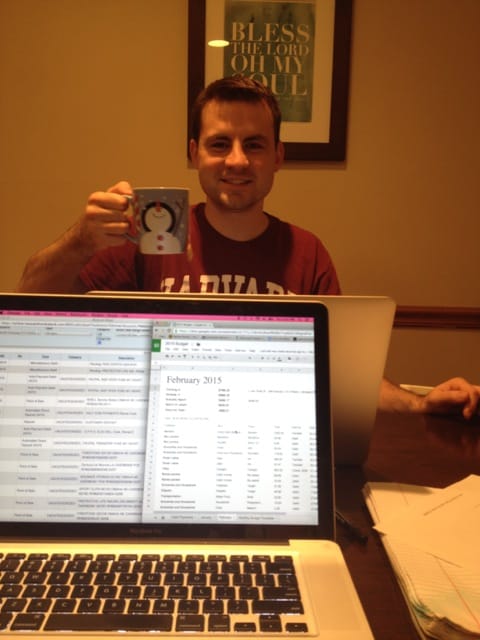

Every single day in January of 2015, we sat down and said, “Did you spend any money today?” We tracked every purchase in a spreadsheet. (We’ve since tried several budgeting softwares and landed on YNAB. But this the budget spreadsheet we used for years and years. Click file–> make a copy to make your own copy to edit.)

It only took 5 minutes each day, which was actually much more pleasant than an hour-long session at the end of the month where we tried to remember every purchase or track down receipts.

As soon as we started sitting down to look at spending together every day, our whole spending mentality changed. While grocery shopping, I couldn’t help but think of the fact that we were trying to stick to our budget, and we’d look at the spending tonight, and I didn’t want to have gone over budget. Ben felt the same way. Amazingly (or perhaps not so amazingly), we didn’t go over budget in any category in January.

Because we were thinking about it all the time, tracking it meticulously, and on the same page.

By February, our spending habits had been almost completely replaced with new ones. Instead of routinely just buying whatever we thought we needed or wanted, the new routine became thinking about the budget and calculating if there was enough left to purchase it.

We switched to categorizing purchases about twice a week in February and were able to maintain the same budgeting success!

In March, and for the rest of the year, we went down to once a week. We just glance at our budget, update any spending, and check the category balances. It takes 10-15 minutes max. This is also when we take care of random financial things like figuring out how to change direct deposit, update W-2s, discuss a bigger-ticket item we might want to buy, budget for an upcoming trip, update our debt-payoff tracking, etc…

A couple months towards the end of the year, we got too big for our britches (who says that?!) and thought we could get by with once a month budget meetings. Honestly, it was more stressful and time consuming because there were so many things to categorize, and I went over budget more often in household/ groceries because I wasn’t checking in weekly to see how much was left to spend.

We’ve decided weekly works best for us. I suggest starting extreme and tapering down from there. If you really want to stick to your budget, record & categorize what you spend every single day for 30 days and see if you’re not better at it. Then, taper down to whatever works for you and your family!

4. I replaced my routine of impulsive buying with something else.

Since I’m by nature a spender, I tend to see something I like, and think, “ooo that’s pretty, I want it.” Before we started treating our budget like a contract, I would go over budget here and there and feel a little guilty but think, “oh I’ll do better next time.” It’s really hard to make progress on financial goals when you spend money like that. Womp womp.

I made 2 keys decisions to fix this and kick my impulsive buying habit.

- No more Target browsing. That store has spent millions of dollars on marketing learning how to get impulsive buyers to spend money and think we’re saving money while spending. For a while, I just didn’t go to Target at all. But there are some things I really prefer to buy there. So, once I allowed myself reentry, I made a rule: I’m only allowed to go with a list. If you find yourself buying random stuff at Target all the time (ahem: dollar & clearance sections), then stop going for a while. I guarantee you’ll have more money in the bank. 🙂

- If I see something I want, I always wait. We give ourselves a certain amount of spending money every month. I plan what I’m going to buy with it in advance so that I don’t get stuck going over budget at dinner with a friend at the end of the month because I already spent my money impulsively. If I see something I like (my guilty pleasures are usually home-decor, clothes, or sewing stuff), I just wait. I used to almost always just buy it. Now I almost always just don’t. It’s that simple. Run out of the store if you have to! 95% of the time, I don’t care or think about that item ever again, and I feel empowered that I didn’t impulsively spend money. Win win! Every so often, it’ll be something I like enough to put it on my mental wish list and I’ll save up my spending money for it in the future.

Fellow impulsive buyers, can I just say to you: it is possible to stop buying things. You can make that decision. No more buyer’s remorse. No more guilt. Give yourself an allotted amount of “fun money,” make a plan for how you’re going to spend it, and then don’t buy extra stuff. You are more likely to be surrounded by and clothed in things you love instead of things you get tired of next week anyway. Do whatever it takes! Tell someone you’re trying to break the habit, cut up the cards, stay out of stores for a while, only carry cash for whatever you are intending to purchase, read books about habit and contentment. There is so much freedom in realizing that you are in complete control of your spending and it doesn’t just impulsively happen anymore.

So, where are you at?

Have you made any budgeting resolutions for 2016?

What is your ‘why’ of budgeting?

What money habits do you have in place that are working and what do you need to change?